- December 22, 2022

- Posted by: admin

- Category: Bookkeeping

You don’t want to be judging yourself on a metric you set yourself—especially when it’s one that’s meant to help you improve your business. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The examples and/or scurities quoted (if any) are for illustration only and are not recommendatory.

What’s considered a good times interest earned ratio?

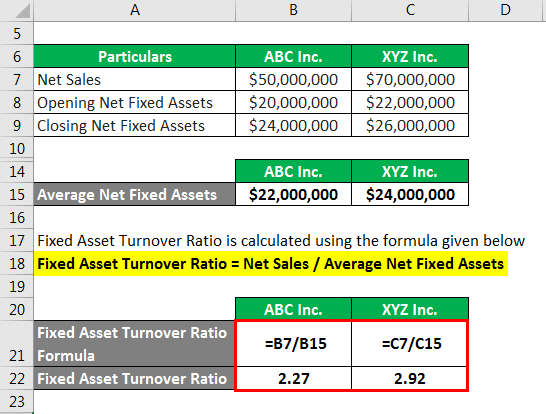

The company generates $1 of sales for every dollar the firm carries in assets. Average total assets are found by taking the average of the beginning and ending assets of the period being analyzed. The standard asset turnover ratio considers all asset classes including current assets, long-term assets, and other assets. It is the gross sales from a specific period less returns, allowances, or discounts taken by customers. When comparing the asset turnover ratio between companies, ensure the net sales calculations are being pulled from the same period.

Balance Sheet Assumptions

An Asset Turnover Ratio of more than 1 is generally a positive indicator. It signifies that the company generates more than a dollar of revenue for every dollar invested in assets. In simple terms, the company is creating more sales per dollar of assets, indicating efficient asset management.

What Is a Good Fixed Asset Turnover Ratio?

Lastly, by combining the asset turnover ratio with DuPont analysis, investors and analysts can gain a comprehensive understanding of a company’s financial performance. Also, pinpoint areas of operational efficiency or inefficiency, and make informed decisions. It could also mean that the company is asset-heavy and may not be generating adequate revenue relative to the assets it owns. A high total asset turnover means that the company is able to generate more revenue per unit asset.

Sally’s Tech Company is a tech start up company that manufactures a new tablet computer. Sally is currently looking for new investors and has a meeting with an angel investor. The investor wants to know how well Sally uses her assets to produce sales, so he asks for her financial statements. For every dollar in assets, Walmart generated $2.51 in sales, while Target generated $1.98. Target’s turnover could indicate that the retail company was experiencing sluggish sales or holding obsolete inventory.

- While investors may use the asset turnover ratio to compare similar stocks, the metric does not provide all of the details that would be helpful for stock analysis.

- Companies with fewer assets on their balance sheet (e.g., software companies) tend to have higher ratios than companies with business models that require significant spending on assets.

- The asset turnover ratio tells us how efficiently a business is using its assets to generate sales.

- This financial ratio provides valuable insights into how effectively the company’s operations utilize its assets to drive its revenue generation.

What that means, exactly, is that the company’s assets generated 25% of net sales over the course of the year. In other words, every $1 in assets that the company owns generated $0.25 in net sales revenue. Again, this can be helpful when using various business valuation methods and trying to determine whether an investment fits your overall strategy.

If you want to compare the asset turnover with another company, it should be done with the companies in the same industry. So, if you have a look at the figure above, you will visually understand how efficient Wal-Mart asset utilization is. This means that for every dollar invested in assets, ABC Corp generates $2 in sales.

A system that began being used during the 1920s to evaluate divisional performance across a corporation, DuPont analysis calculates a company’s return on equity (ROE). It breaks down ROE into three components, one of which is asset turnover. On the other hand, company XYZ, a competitor of ABC in the same sector, had a total revenue of $8 billion at the end of the same fiscal the asset turnover ratio is calculated as net sales divided by year. Its total assets were $1 billion at the beginning of the year and $2 billion at the end. Spend management encompasses organization-wide spending, accounting for invoice (accounts payable) and non-invoice (T&E) spend. Spend management software gives businesses a more comprehensive overview of cash flow and expenses, and Rho fully automates the process for you.

It is an accounting formula that allows a business to see how efficiently they’re using their assets to create sales. A good asset turnover ratio will differ from business to business, but you’ll typically want an asset turnover ratio greater than one. To do so, divide the company’s net sales (or total revenue) by its average total assets formula during a specific period.

The limitations outlined above play into some of the potential drawbacks of the asset turnover ratio when analyzing stocks, too. Mostly, it comes down to the fact that as a single ratio, which doesn’t reveal the total health or financial picture for a single company. For that reason, it’s probably a good idea to use the ratio in tandem with other analysis tools and methods.

By dividing the number of days in the year by the asset turnover ratio, an investor can determine how many days it takes for the company to convert all of its assets into revenue. While asset turnover ratio is a good measure of how efficient management is at using company assets, it isn’t everything. There are many other things involved in running a company such as cost, market share and brand name recognition.